The American Rescue Plan Act was signed into law by President Biden on March 11, 2021, it guaranteed direct funding to all cities, towns and villages in the United States. The U.S. Department of the Treasury responsible for overseeing the program.

NLC has identified your frequently asked questions about State and Local Fiscal Recovery Fund (SLFRF) grants program. These answers will be updated as additional information becomes available.

We’ve organized the frequently asked questions in sections to help guide you.

Introduction to the American Rescue Plan Act

- Where can I find in-depth information on the American Rescue Plan Act (ARPA)?

- What is the Final Rule?

- What guidance is available?

Receiving Funds

- How was my city allocated funds?

- How were NEUs allocated funds?

- When will my city receive the second tranche of funding?

Compliance and Reporting

- What are SLFRF reporting requirements?

- What is a UEI Number?

- What is an active SAM registration?

- How do I submit funding reports?

- When do I need to submit funding reports?

- Is there a deadline to report or spend the funds?

- How do I calculate my city’s lost revenue?

- What is the Standard Allowance?

Eligible Uses

- What are eligible uses for funding?

- Can recovery funds be used to fund lost revenue?

- Can recovery funds be used for stormwater projects and expenses?

- Can my city decrease taxes after receiving these funds?

- What infrastructure projects can funds be used on?

- Can recovery funds be used to cover administrative costs?

- Can recovery funds be used to relieve other payroll costs?

- Can recovery funds be used for pensions?

- What is ARPA Flex and what are the new expenditure categories it created?

- If I use SLFRF funds for a surface transportation project, is that project subject to the National Environmental Policy Act (NEPA)?

Introduction to the American Rescue Plan Act

Where can we find in-depth information on the American Rescue Plan Act (ARPA)?

The following list includes some of the available resources that provide guidance on ARPA, compliance, and reporting requirements:

- Senate Bill Summary Links:

- Treasury Resources:

- Coronavirus State and Local Recovery Funds

- 2022 Final Rule

- 2022 Final Rule Overview

- Treasury Final Rule FAQs

- Compliance and Reporting Guidance

- Information for NEUs

- Project and Expenditure Reporting Guide (Updated April 2022)

- 2023 Interim Final Rule

- 2023 Interim Final Rule Overview

- 2025 Treasury’s How To Guide

- Walkthrough Demonstration Video

- Final Rule

In addition, NLC has created and continues to develop resources for members on specific ARPA-related questions/issues. A number of these are referenced throughout the answers to these Frequently Asked Questions.

What is the Final Rule?

The Final Rule was released on January 6, 2022 and took effect on April 1, 2022. State and local funding allocated in the American Rescue Plan Act is subject to the specifications outlined in the Final Rule. The Final Rule provides a comprehensive list of eligible expenditures, encouraged expenditures, and prohibited expenditures. The Final Rule Overview provides a non-exhaustive list of provisions in the Final Rule and serves as a guide for some of the actions municipalities may take in utilizing their recovery funds.

Learn more about what the Final Rule means for local government leaders here.

What guidance is available?

The U.S. Department of Treasury provides guidance for cities on determining eligible uses, allocating funds, and reporting and compliance of their local fiscal recovery funds.

There are additional resources available for Non-Entitlement Units of Local Government (NEUs), or municipalities generally with a population under 50,000, as well. This guidance from Treasury includes information states used to allocate funding to NEUs, as well as guidelines for crucial reporting and compliance measures.

The Compliance and Reporting Guidance, released in February 2022, provides an overview of the Project and Expenditure Report and Recovery Plan Performance Report required to be submitted by cities, towns and villages to Treasury.

Treasury has released a series of webinars on State and Local Fiscal Recovery Funds, which outline the most important details from the Final Rule, while also covering expenditure reporting.

Finally, NLC has released a variety of blogs and webinars on to help ensure municipalities are equipped to spend their funds as efficiently and effectively as possible.

Receiving Funds

How was my city allocated funds?

Methodology

The Act provides that the Secretary shall substitute “all metropolitan cities” for “all metropolitan areas” in each place it appears. This substitution removes urban counties, which are provided for separately under the Act, 4 from the ratios used in the calculation of allocations for metropolitan cities. The Act also provides that the Secretary shall allocate and pay to each metropolitan city an amount determined for the city “consistent with” the CDBG formula.

As noted, the CDBG formula uses six weighted variables.5 This formula reflects an approach taken since the 1970s on how to assess communities’ needs for funds to provide suitable living environments and expanded economic opportunities, particularly for low-income communities. But applying the formula solely by substituting “all metropolitan cities” for “all metropolitan areas” has the effect of changing the relative importance of the variables: in particular, it alters the weight normally assigned to “population growth lag.”

While substituting “all metropolitan cities” for “all metropolitan areas” ensures that all of the metropolitan cities’ allocation will be distributed, a substitution that changes the relative importance of the variables that drive the underlying CDBG formula would produce results that are not “consistent with” with the formula, as the statute requires. To achieve the statutorily mandated consistency with the CDBG formula, while still “substitut[ing] ‘all metropolitan cities’ for ‘all metropolitan areas’ each place it appears,” Treasury has adjusted the relative weights of the ratios that make up the formula to reflect the same relative importance of the ratios absent the substitution.

Coronavirus Local Fiscal Recovery Fund grants are formula grants and under the formula, every municipal government is entitled to receive a calculated share of the $65.1 billion for cities, towns, and villages. These are not competitive grants and local governments will never need to submit an application or justify their needs in advance to receive funding. There are, however, steps to be taken to ensure local governments receive their grants.

How were NEUs allocated funds?

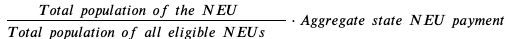

Non-entitlement units of local government (NEUs), or generally municipalities with fewer than 50,000 residents, received their ARPA funding through their state government. States calculated the funding using the following equation, and a spreadsheet of funding designated to each NEU in your state should be available online:

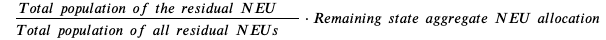

The second tranche of remaining funding would be dispersed by the state based on the following calculation:

Non-entitlement units of local government (population <50,000) must have a valid UEI number and active SAM registration to meet reporting requirements.

Compliance and Reporting

What are SLFRF reporting requirements?

For metropolitan cities and non-entitlement units of local government to receive their SLFRF funding, they must abide by the following reporting requirements:

- Having a Unique Entity Identifier (UEI) number

- Having an active SAM registration, which must be renewed annually

- Reporting funding obligations and expenditures, quarterly or annually, depending on municipality size (see below)

What is a UEI Number?

A Unique Entity Identifier (UEI) number is a unique 12-digit number assigned to each municipality for use in reporting their fiscal recovery funding on SAM.gov.

As of April 4, 2022, the federal government switched from the DUNS number to the UEI number. If you have an existing registered entity but do not know your UEI number, you will find your UEI number on SAM.gov. New entities will receive their UEI number when registering on SAM.gov.

What is an active SAM registration?

SAM is the official government-wide database to register with in order to do business with the U.S. government. All Federal financial assistance recipients must register on SAM.gov and renew their SAM registration annually to maintain an active status to be eligible to receive Federal financial assistance. There is no charge to register or maintain your entity SAM registration.

Metropolitan cities and NEUs will need an active SAM registration to receive funds, and ALL cities will need an active SAM registration to submit reports through the Treasury reporting portal. NEUs who have not previously registered with SAM.gov may do so after receipt of the award, but before the submission of mandatory reporting.

If an entity does not have an active SAM registration, please visit SAM.gov to begin the entity registration or renewal process. Please note that SAM registration can take up to several weeks.

How do I submit my funding reports?

Each designated individual in a jurisdiction should register with a login.gov account, which will give each registered individual access to Treasury’s Reporting and Compliance Portal.

Some municipalities may have already registered to report through ID.me. If that is the case, there is a separate Portal through which municipalities may submit their expenditure reports.

If you need assistance submitting your reports, please contact slfrf@treasury.gov.

When do I submit my funding reports?

Specifications for future deadlines depend on the type and size of municipality. Project and Expenditure Reports are due 30 days after the end of the quarter for Metropolitan Cities, and by April 30 for NEUs.

Is there a deadline to report or spend the funds?

SLFRF funding must be obligated by December 31, 2024 and jurisdictions have until December 31, 2026 to fully expend their funds. Spending should be used for costs incurred after March 3, 2021.

How do I calculate my city’s lost revenue?

If you are not using the standard allowance up to $10 million in revenue loss, the funding your city receives will be based on its lost revenue. Lost revenue is equal to counterfactual revenue – actual revenue (adjusted for tax changes). If counterfactual revenue is greater than actual revenue, the loss is set at $0.

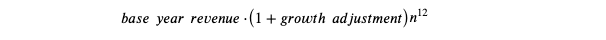

Counterfactual revenue can be calculated using the following equation:

n is the number of months elapsed since the end of the base year to the calculation date. The growth adjustment is the greater of either a 5.2% standard growth rate, or the recipient’s average annual revenue growth in the last full three fiscal years prior to the COVID-19 pandemic.

Actual revenue is the total revenue collected over the 12 months immediately preceding the calculation date.

There is an example of this calculation in the Revenue Loss section of the Final Rule, which may be helpful if your municipality is still looking to calculate revenue loss during the pandemic.

What is the standard allowance?

Treasury has encouraged NEUs to utilize the “standard allowance” for SLFRF funds, which allows a municipality to claim up to $10M in revenue loss funding to each, regardless of actual loss of revenue. However, the revenue loss amount cannot exceed the size of the grant. Municipalities had to choose whether they were going to use the Standard Allowance by the April 30, 2023 reporting deadline. Local governments may spend these funds on government services.

Filing using the standard allowance streamlines the process of reporting and compliance. If an NEU chooses not to receive their funding under the standard allowance, it must classify its projects under one of the expenditure categories outlined by Treasury, rather than generally under revenue loss.

Eligible Uses

What are eligible uses for funding?

Municipalities are granted flexibility in choosing how they will spend their ARPA funds. As outlined in the Final Rule, funding must fit into one of the following categories:

- Responding to the public health and negative economic impacts of the pandemic

- Providing premium pay to essential workers

- Providing government services to the extent of revenue loss due to the pandemic

- Making necessary investments in water, sewer, and broadband infrastructure

- Disaster Relief (see more in ARPA Flex section)

- Surface transportation (see more in ARPA Flex section)

- Community development Block Grants (see more in ARPA Flex section)

Responding to the public health and negative economic impacts of the pandemic includes:

- Utilizing funding for programs or services in response to those impacted by the negative health and economic impacts of the pandemic, including the general public

- Providing funding that can be utilized by households, populations, or classes that experienced pandemic impacts, including disproportionately impacted communities

- Responding with funds for COVID-19 mitigation and prevention, medical expenses, behavioral healthcare, and preventing and responding to violence

- Providing additional assistance to households, small businesses, and nonprofits

- Granting assistance to impacted industries, including tourism, travel, and hospitality that faced inordinate impacts due to the pandemic

Funding to provide government services to the extent of revenue loss due to the pandemic includes:

- Permitting spending of a standard allowance of up to $10 million, not to exceed a city’s award amount, during the program, or

- Calculating a municipality’s specific revenue loss using a formula set forth by Treasury

The commitment to make investments in water, sewer, and broadband infrastructure includes:

- Allowing funding for improving access to clean drinking water, supporting vital wastewater and stormwater infrastructure, and expanding affordable access to broadband

- Granting access to a broad range of water and sewer projects, including the EPA’s Clean Water State Revolving Fund, EPA’s Drinking Water State Revolving Fund, and certain additional projects, including a wide set of lead remediation, stormwater infrastructure, and aid for private wells and septic units

- Providing funds for high-speed broadband infrastructure in areas of need, including those without access to high speeds, affordable options, or where connections are unreliable

All SLFRF funding must fit into one of the general categories listed above. The Final Rule provides further detail on the allowances for funding and information on compliance responsibilities. However, the Final Rule provides a non-exhaustive list of uses and municipalities may use their funds in any way that responds directly to a pandemic impact. Spending for each category has its own distinct reporting requirements.

Can recovery funds be used to fund lost revenue?

Yes, recipients can use SLFRF dollars to fund lost revenue. This is one of the eligible uses of ARPA funds. The fiscal relief funds give recipients broad latitude to use funds to provide government services to the extent of the reduction in revenue or the standard allowance. Government services can include but are not limited to, maintenance of infrastructure, modernization of cybersecurity, health services, school or educational services, and public safety services. When calculating lost revenue, recipients should sum across all revenue streams covered as general revenue, for administrative ease.

Can SLFRF funds be used for stormwater projects and expenses?

Recipients may use State and Local Fiscal Recovery Funds to invest in necessary improvements to their water and sewer infrastructures, including projects that address the impacts of climate change. Recipients may use this funding to invest in an array of drinking water infrastructure projects, such as building or upgrading facilities and transmission, distribution, and storage systems, including the replacement of lead service lines.

Recipients may also use this funding to invest in wastewater infrastructure projects, including constructing publicly-owned treatment infrastructure, managing and treating stormwater or subsurface drainage water, facilitating water reuse, and securing publicly-owned treatment works.

To help jurisdictions expedite their execution of these essential investments, Treasury’s Final Rule aligns types of eligible projects with the wide range of projects that can be supported by the Environmental Protection Agency’s Clean Water State Revolving Fund and Drinking Water State Revolving Fund. Recipients retain substantial flexibility to identify those water and sewer infrastructure investments that are of the highest priority for their own communities.

Can my city decrease taxes after receiving these funds?

The rule that would prohibit tax decreases is a restriction only on states. The local government section of the bill contains no prohibition on lowering taxes.

What infrastructure projects can funds be used on?

NLC has created resources on using funds for infrastructure projects:

- Using American Rescue Plan Act Funds for Water, Wastewater and Stormwater Infrastructure Projects

- Treasury Expands Broadband Eligibility for ARPA in a Win for Cities

- How Local Leaders Can Help Residents Access the Emergency Broadband Benefit

- How Communities Are Using ARPA to Improve Infrastructure

Can recovery funds be used to cover administrative costs?

Yes, funds may be used to pay administrative costs, including payment to consultants and/or payroll to assist with the implementation of ARPA projects. This includes costs of consultants to ensure effective project management, as well as legal and regulatory compliance. Funds may be used to increase staff capacity in order to stabilize government operations.

Can recovery funds be used to relieve other payroll costs?

The statute provides that recipients may not use Fiscal Recovery Funds for “deposit into any pension fund.” For the reasons discussed below, Treasury interprets “deposit” in this context to refer to an extraordinary payment into a pension fund for the purpose of reducing an accrued, unfunded liability. More specifically, the final rule does not permit this assistance to be used to make a payment into a pension fund if both:

- the payment reduces a liability incurred prior to the start of the COVID-19 public health emergency, and

- the payment occurs outside the recipient’s regular timing for making such payments.

Under this interpretation, a “deposit” is distinct from a “payroll contribution,” which occurs when employers make payments into pension funds on regular intervals, with contribution amounts based on a pre-determined percentage of employees’ wages and salaries.

Can recovery funds be used for pensions?

The statute provides that recipients may not use Fiscal Recovery Funds for “deposit into any pension fund.” For the reasons discussed below, Treasury interprets “deposit” in this context to refer to an extraordinary payment into a pension fund for the purpose of reducing an accrued, unfunded liability. More specifically, the final rule does not permit this assistance to be used to make a payment into a pension fund if both:

- the payment reduces a liability incurred prior to the start of the COVID-19 public health emergency, and

- the payment occurs outside the recipient’s regular timing for making such payments.

Under this interpretation, a “deposit” is distinct from a “payroll contribution,” which occurs when employers make payments into pension funds on regular intervals, with contribution amounts based on a pre-determined percentage of employees’ wages and salaries.

What is ARPA Flex and what are the new expenditure categories it created?

On August 10, 2023 Treasury issued a Interim Final Rule for ARPA Flex. This provision allows for spending in three new expenditure categories.

- Spending to provide emergency relief from natural disasters.

- Spending on transportation infrastructure eligible projects and matching funds.

- Spending on any program, project, or service that would also be eligible

- under HUD’s Community Development Block Grant program.

These categories come with their own set of compliance requirements. To explore whether you are eligible to spend SLFRF on these categories, please view this comprehensive resource for more information.

If I use SLFRF funds for a surface transportation project, is that project subject to the National Environmental Policy Act (NEPA)?

Yes, certain projects under the new ARPA Flex eligibilities are subject to NEPA. For more details, click here.

Who can I contact for more information if I still have questions?

If you have additional questions about your SLFRF funds, you may contact the US Treasury at slfrf@treasury.gov.

If you would like assistance from the National League of Cities, please contact our Federal Advocacy team at advocacy@nlc.org.

Stay Informed

Sign up for the latest federal updates from NLC!