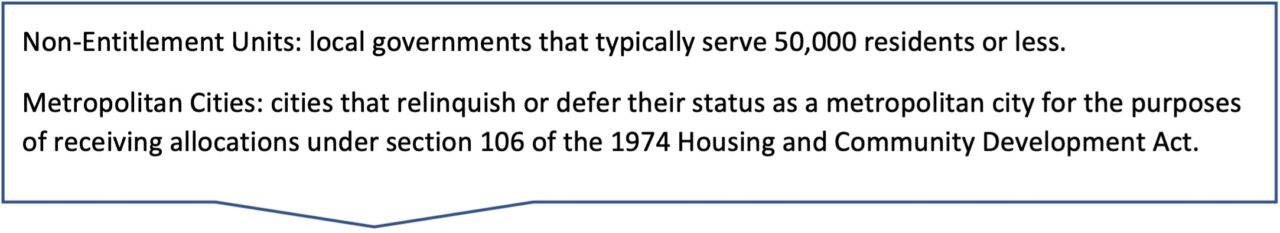

On March 11th, 2021, President Biden signed into law the American Rescue Plan Act (ARPA) to provide Coronavirus State and Local Fiscal Recovery Funds (SLFRF) to every municipality in America. Of the $350 billion available SLFRF funds, ARPA allocated nearly 6 percent, or $19.5 billion, to non-entitlement units (NEU).1 Comparatively, ARPA allocated about 13 percent, or $45.6 billion, to metropolitan cities.

To deliver the NEU funds, Congress required the states to distribute the grants from the U.S. Treasury Department to the eligible municipalities and allocate a calculated share of those funds to every NEU. ARPA defines the NEU allocation formula as “the proportion of the population in the NEU as a share of the total population of all NEUs in the state,” which is then multiplied by the state’s NEU payment2,3. To prevent over-awarded grant amounts, states must cap the size of individual grants at 75 percent of the NEU’s total annual budget. If the calculated allocation is greater than 75 percent of the NEU’s budget, the state must return the excess funds to the Treasury Departmenti.

Given the reliance on state governments, there is currently no official source that provides detailed allocations for all NEUs like there is for metropolitan cities. To address this gap and to better understand the distribution of funds to smaller communities, NLC collected data from reputable sources in 49 statesii, including state governments and state municipal leagues. Allocations for all municipalities, including NEUs, are available via NLC’s updated Local Allocation Tracker. NLC used this new dataset to analyze the spatial and per capita distribution of funds to NEUs.

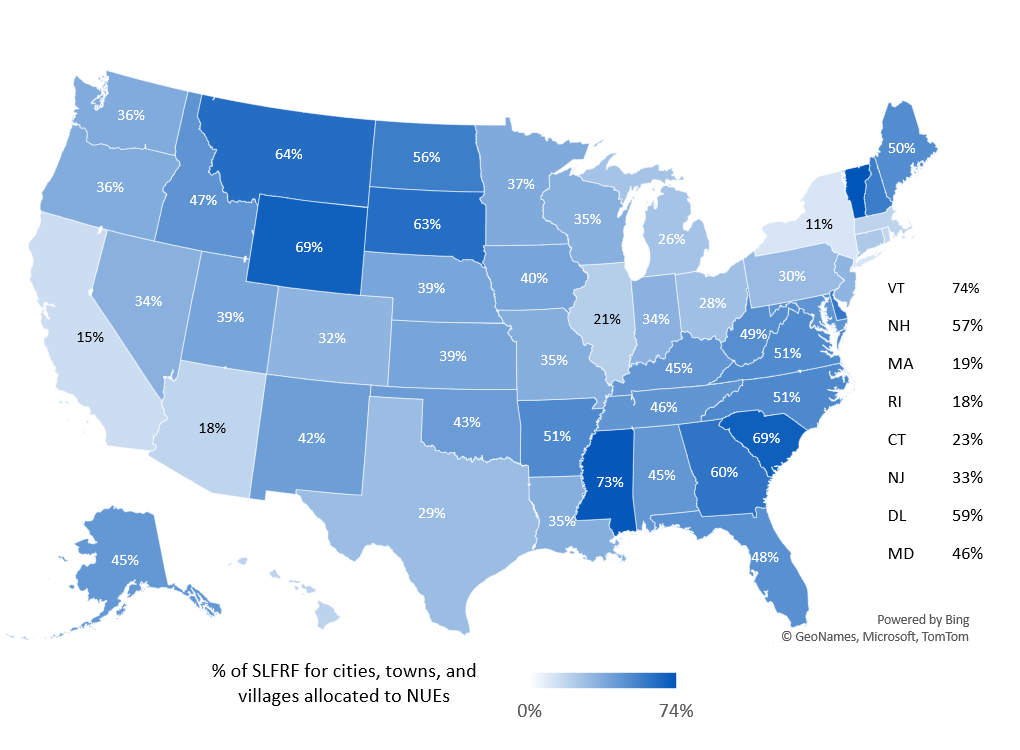

NEU Allocations Align with Population Distribution

The share of a state’s total pot of SLFRF funds allocated to individual NEUs varies significantly depending on the spatial distribution of the population within the state. States with a larger percentage of the population living in NEUs have a significantly greater percentage of SLFRF funds allocated to NEUs. Although this alignment might seem obvious, it is a departure from how allocations were determined for metropolitan cities.

Allocations for metropolitan cities are based on the Community Development Block Grant Program allocation formula, which determines allocations based on both population and poverty levels within a given city. The states with the highest share of SLFRF funds allocated to NEUs are Vermont (74%), Mississippi (73%), and South Carolina (69%) (Figure 1). The states with the lowest percent of SLFRF funds allocated to NEU’s are New York (11%), California (15%), and Rhode Island (18%).

Small Cities, Big Opportunities

As cities, towns and villages across America begin receiving their ARPA dollars, they are at a pivotal moment to use these funds effectively for their communities to recover from the pandemic. For many NEUs, this is their first experience receiving federal dollars of this magnitude. As these communities familiarize themselves with their new responsibilities, ARPA can act as a stepping stone that allows our smallest municipalities to become equipped for future federal funding opportunities to continue addressing their community’s needs.

Learn More

To learn more about how other NEUs are using their ARPA funds, visit NLC’s Local Action Tracker for the most complete collection of municipal responses to COVID-19.

- https://home.treasury.gov/system/files/136/SLFRP-Quick-Reference-Guide-FINAL-508a.pdf

- https://home.treasury.gov/system/files/136/NEU_Guidance.pdf

- To learn more about the total state NEU allocations, see the Allocation for Non-Entitlement Units.

i – Once states receive their NEU allotments, they have 30 days to distribute the funds. To disburse the funds, ARPA requires states to establish a process to receive documentation from the NEUs, such as their financial institution’s information, budget, and a signed award terms and conditions agreement. States may apply for a 30-day extension if they did not receive applications from all the NEUs to disburse the funds. A second 30-day extension may be granted if there are outstanding applications; however, the state must detail the expected time for disbursing the remaining funds and the efforts they will take to complete the distributions. In the case that the NEUs remain non-responsive, the excess funds the state received can be distributed amongst “residual NEUs,” which are NEUs that received an initial distribution and did not meet the 75 percent cap. The state determines the residual NEUs’ subsequent distribution by calculating the proportion of the population in the residual NEU as a share of the total population of all the residual NEUs multiplied by the state’s remaining NEU allocation. For the subsequent distribution, the 75 percent budget cap remains, and any amounts allocated in excess of the residual NEU’s budget cap must be returned to Treasury.

ii – Excluding the state of Hawaii due to their lack of NEUs.