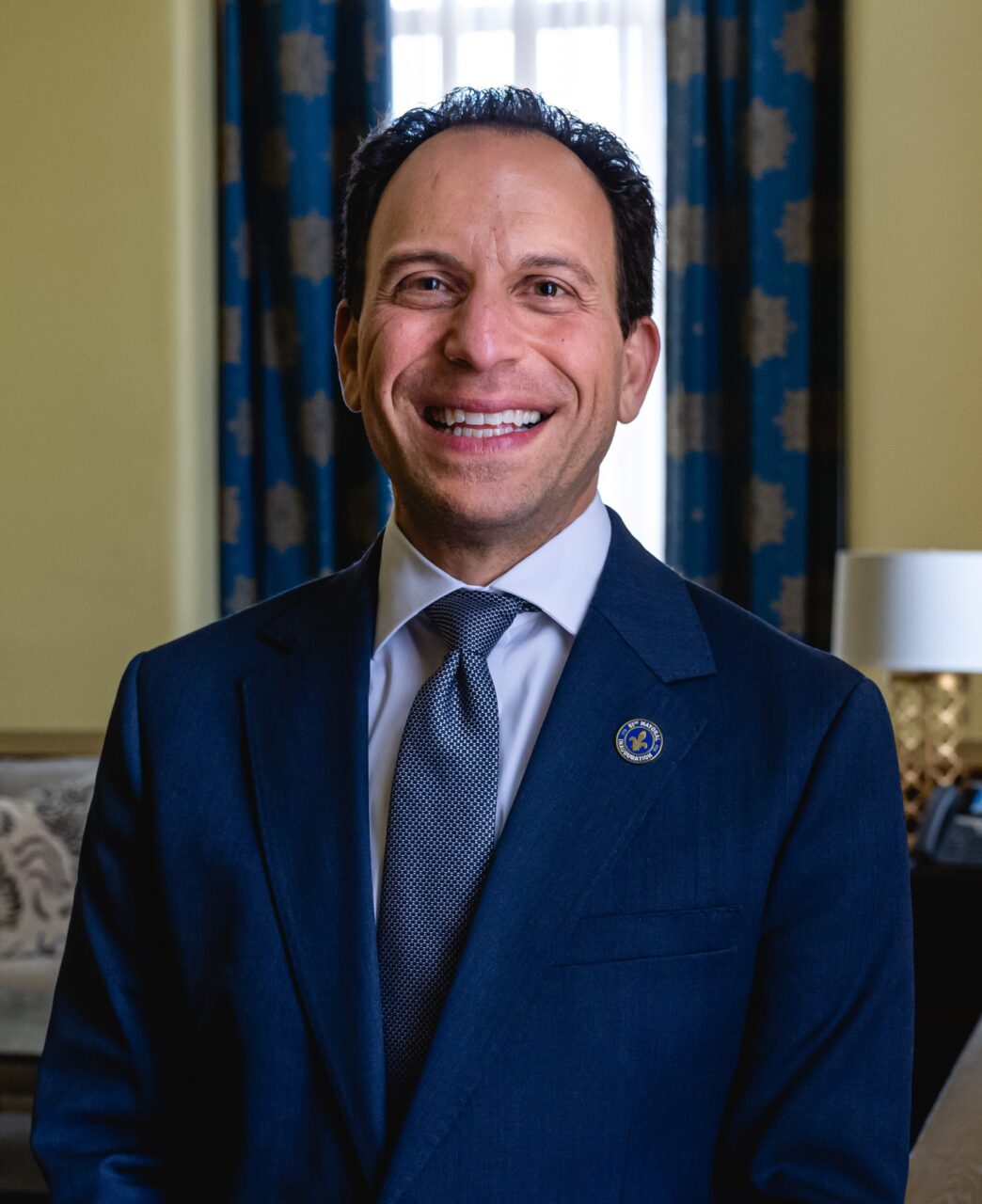

By Mayor Craig Greenberg, Louisville, Kentucky

As mayor of Louisville, my goal is to help families across our city succeed in our community—and that is a goal our entire team at Louisville Metro Government shares. To do that, we are working urgently to make our city a safer, stronger, and healthier place to call home by empowering every Louisvillian with the resources they need to thrive.

Nearly 20 percent of Louisville households have zero or negative net worth, and a quarter of families have no retirement savings.

Source: Prosperity Now Scorecard

According to our work with Louisville families, almost 40 percent of Louisville households lack sufficient savings to sustain three months of living expenses in the event of a shock to income, like the loss of a job or an unexpected medical expense.

While this kind of financial vulnerability is most intensely felt by those living on low incomes, even those above the poverty line struggle with debt. Louisville households of color disproportionately represent households with zero net worth, experience incomes below the poverty threshold, have higher rates of insufficient liquid savings, and are much less included in our financial mainstream. Closing the racial wealth gap and addressing financial vulnerability requires access to safe and affordable financial products and services.

Louisville’s Volunteer Income Tax Assistance (VITA) program is a critical piece of our city’s financial stability puzzle. Since 2001, the Louisville Asset Building Coalition (LABC) has provided free tax services in Louisville and surrounding areas of Jefferson County. It returns millions of dollars back into the pockets of hard-working Louisville families. Through the VITA Program and in partnership with the IRS, LABC ensures that working families and individuals are maximizing their tax benefits, receiving quality tax preparation services, and gaining access to asset-building opportunities.

While LABC is an independent nonprofit, they are strongly supported by the Louisville Metro Government’s Office of Resilience & Community Services (RCS), which houses our Office of Financial Empowerment.

Source: LouisvilleKY.gov

This close connection is intentional and purposeful to support a comprehensive financial empowerment ecosystem for our Louisville residents.

Tax season is often the point in time in which many families get their single greatest liquid asset infusion of the year. This provides many an opportunity to get caught up on missed payments, pay down debt, make purchases otherwise unaffordable, such as car or home repairs, and have resources to look ahead to the future. It is often the goal of VITA programs to encourage families to save all or part of their refund, a strategy that, without a holistic approach, may not be well received.

In Louisville, we strive to talk about tax time all year long to help prepare residents to make the best choices for their families. Programs such as Bank on Louisville, Louisville Financial Empowerment Center counseling, and key integrations into public services such as the Low Income Energy Assistance Program (LIHEAP), rental assistance, and homeownership counseling allow our VITA program to not only serve as a resource during tax season but also in the off-season to help resolve taxpayer concerns, file for missed past returns, and to advocate for financial wellness year-round.

VITA integration strategies in Louisville include:

Tax Time Connect

In 2021, through a grant from the Cities for Financial Empowerment Fund, LABC and Bank On Louisville piloted a full-time financial advocate on-site at the Louisville Urban League, the largest VITA site in our city. Tax Time Connect fosters conversations with tax filers about their banking status and coaches them about the benefits of banking and direct deposit of their tax refund. Through this process, filers had support from the Advocate to open accounts in-person or remotely and to successfully receive refunds via their new bank account. This project was so successful that the financial advocate is now employed full-time and continues to work with tax filers year-round.

Louisville Financial Empowerment Center (FEC)

The Louisville FEC launched in July 2022 and established financial counseling as an essential city service. As the 30th city in the country to adopt this national model, the Louisville FEC ensures that financial counseling services are accessible and available to all Louisville residents at no cost. The FEC provides professionally trained and certified counselors to address issues of banking, credit, debt, and savings with Louisville residents. Counselors also provide a strong connection to VITA-free tax services with each FEC client.

Community Financial Empowerment Certification and Training Program (CFEC)

The CFEC is designed for social service providers and support staff to expand their knowledge of personal finance and economic decision-making for their clients. The goal of CFEC Level 1 is to train service providers to initiate financial empowerment conversations and inform them of the community resources that further support clients’ financial goals, including local tax resources.

We are tremendously proud of the wide array of financial resources available to our citizens through the Office of Financial Empowerment, and the results speak for themselves. Because of OFE’s work, more Louisvillians are able to participate in banking, save money for things like vehicles and home ownership, and rest easy during tax season, knowing that there is expert help available.

Make the Connection

Sign up for NLC’s Economic Mobility Peer Network to connect with other cities and hear from leading experts on topics designed to help cities boost residents’ economic mobility using strategies grounded in equity.