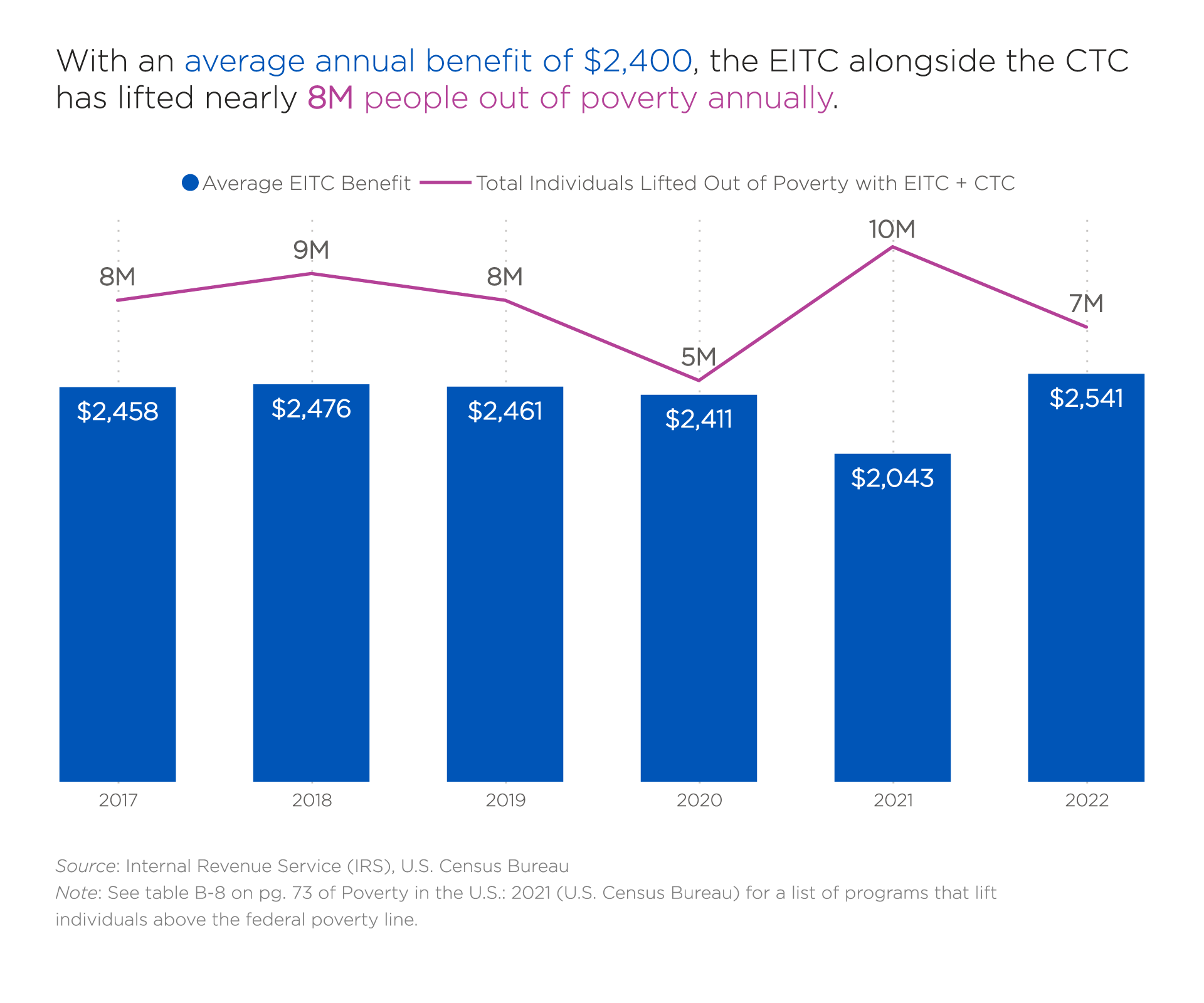

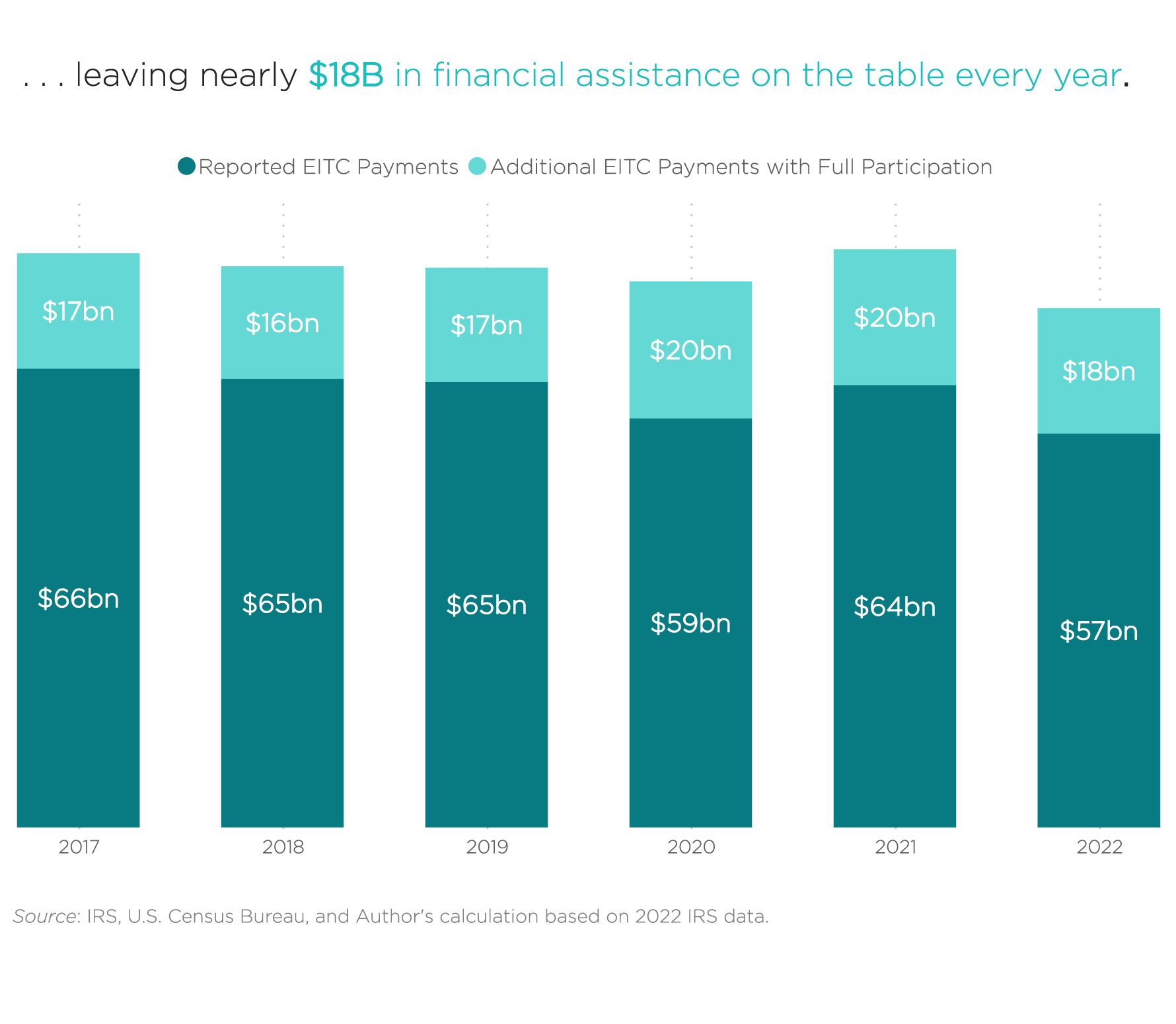

On Earned Income Tax Credit (EITC) Awareness Day, let’s not leave billions of dollars in EITC benefit on the table. Filer benefits of around $2,500 (as of 2022) can provide greater financial stability and drive positive health outcomes for residents in your communities. Communities can conduct targeted outreach and assist eligible filers to claim this benefit, which can ultimately help to stimulate local economies.

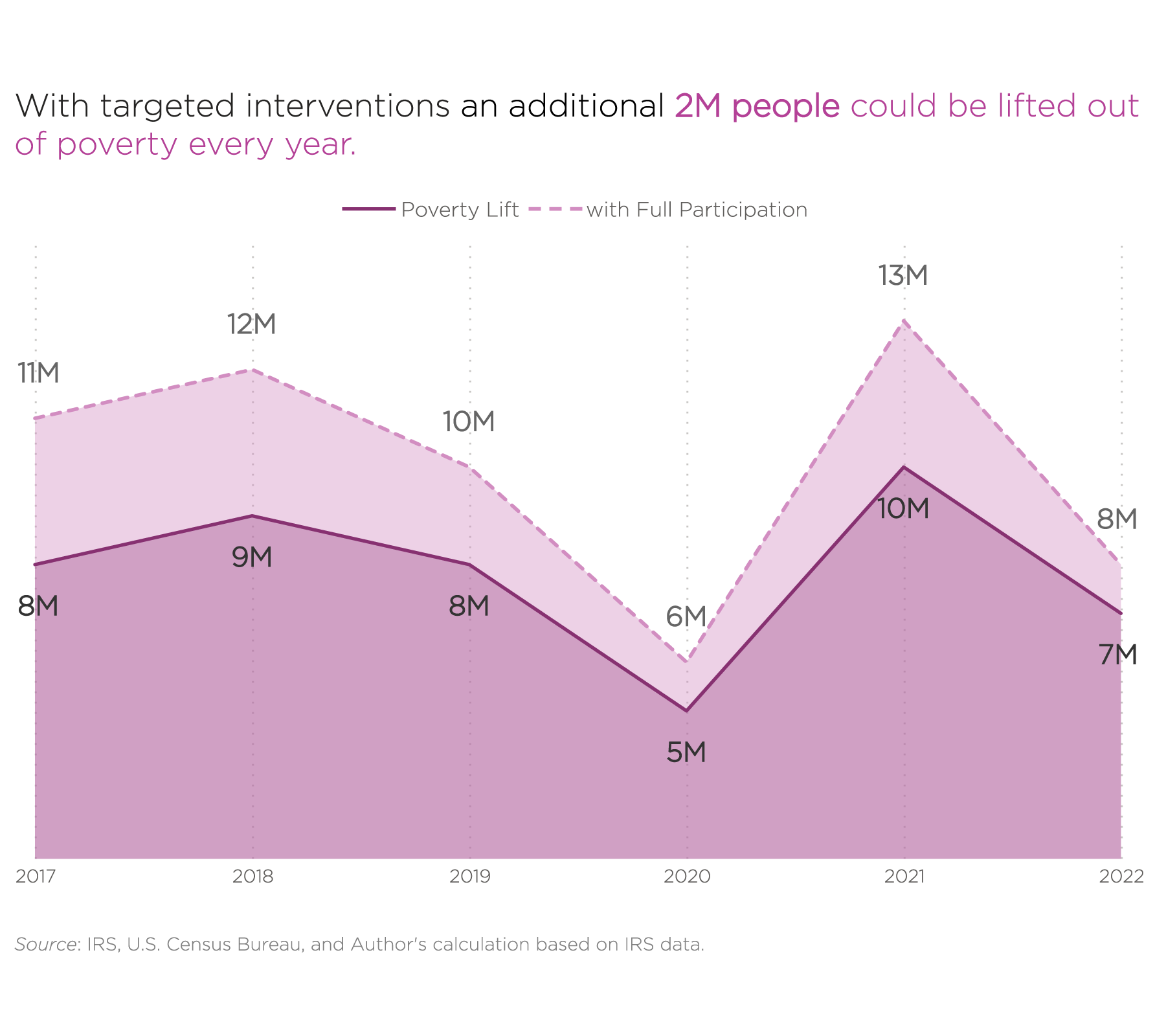

The EITC and similar benefits, such as the Child Tax Credit (and the historic expanded Child Tax Credit per the American Rescue Plan in 2021) have, on average, lifted nearly 8M individuals out of poverty per year from 2017 to 20211.

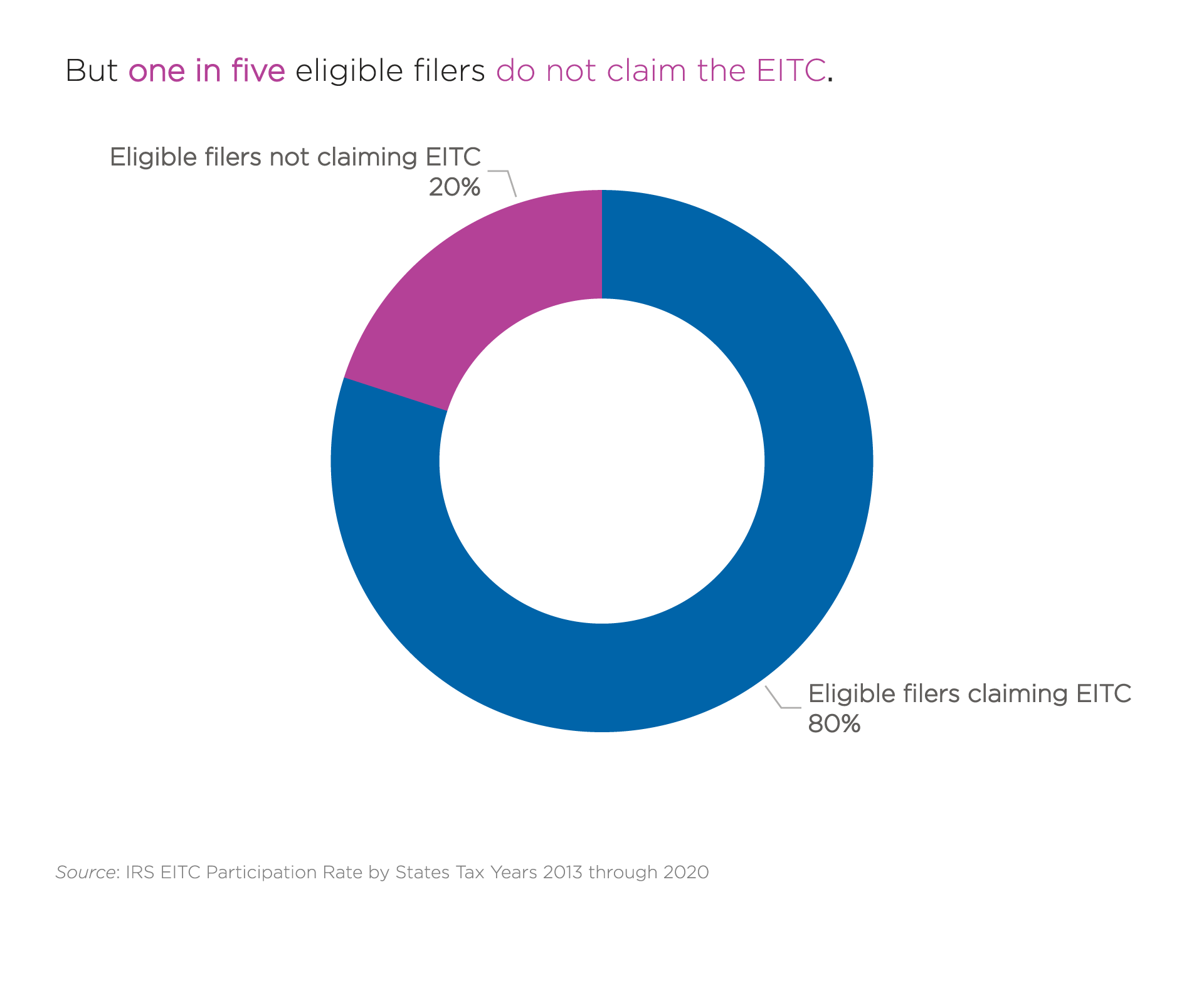

Such benefits are even more important at a time when poverty is on the rise. According to the U.S. Census Bureau, 3.6M people fell into poverty between 2019 and 2020, an 11% increase from 34M to 37.6M people, the highest single-year increase in a decade. The total number of people living in poverty increased to 37.9M by the end 2022. In recent years, an estimated 20% of eligible filers didn’t claim the EITC, representing, for example, approximately 8.1M households in 20204.

Qualifying households and individuals that did not file for the 2020 tax year have until May 17, 2024, to claim the benefit. These potential filers may qualify if they meet one or more of the following criteria:

- Single individuals who worked and earned less than $16,000;

- Single or married parents of at least one child who worked and earned less than $50,000;

- Individuals who worked and lost their partner and as a result a significant portion of their household income; and

- Working grandparents raising their grandchildren or other working adults who took on the responsibility of caring for dependent children in 2020.

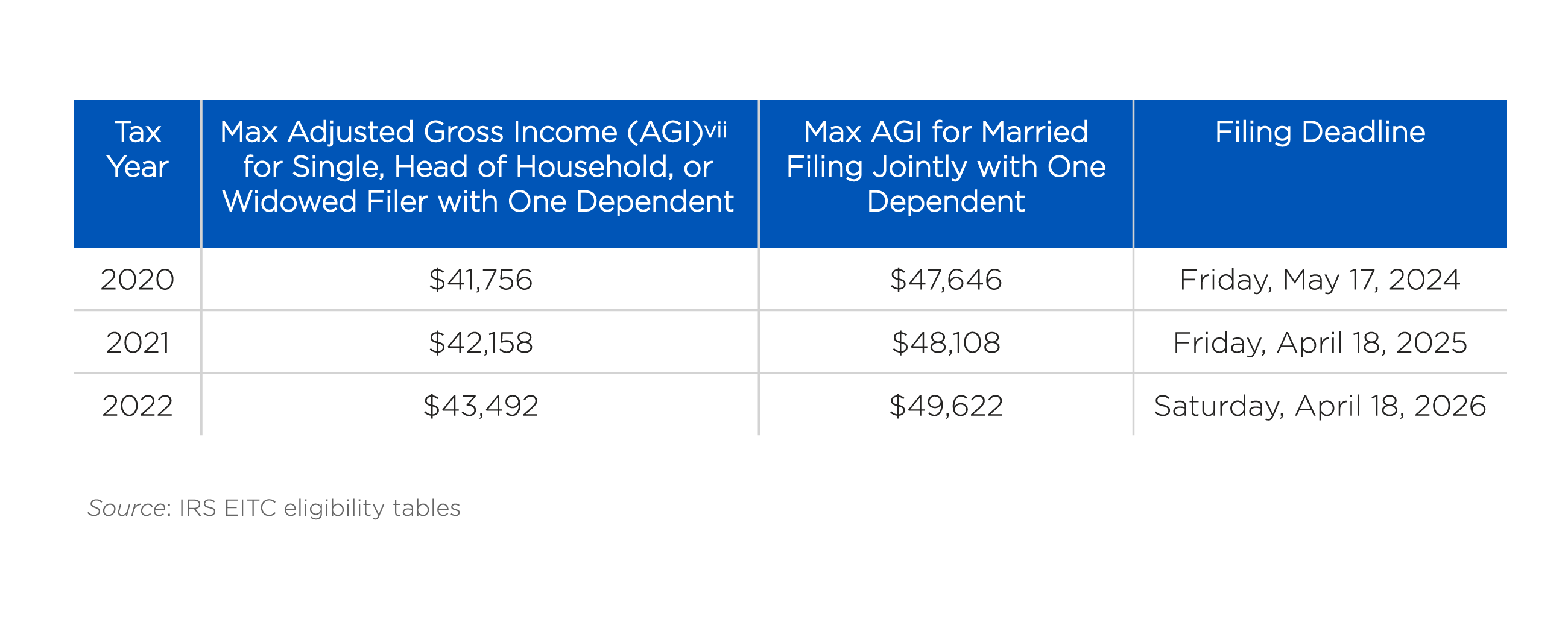

The IRS provides a three-year window to apply for the EITC, giving local governments, nonprofit organizations, and employers time to plan and implement outreach efforts to eligible tax filers that have not yet filed. Using the information in the table below, these entities can encourage their residents to capture federal benefits to support themselves and their communities. See the table below for filing eligibility and deadlines, and the IRS website for more detailed information.

Select EITC Income Criteria and Filing Deadlines for 2020-2022

Given the power of the EITC to provide greater financial stability and drive positive health outcomes, let’s not leave money on the table, especially at a time when people are still struggling. To assist cities with outreach and education efforts, NLC will:

- Launch an EITC mapping tool this spring using recent IRS data that will allow users to identify zip codes in their communities that have the highest potential for expanded EITC participation.

- Stand up a data users community this year to make tax data by geographic area (e.g., county, zip code) more accessible and usable, facilitate responses to common questions, and share best practices.

- Host a data conference in 2025 with the IRS and other partners to celebrate the 50th anniversary of the EITC, showcasing new and novel ways of using data to expand EITC participation, achieve greater financial stability, and spur local economies.

With the Economic Impact Payments in 2020 and 2021 the IRS demonstrated how it was possible to automatically identify eligible recipients and disburse payments. There is hope that they can someday automate the delivery of the EITC. Absent this, communities, employers, and nonprofits will need to continue to conduct targeted outreach and assist eligible filers to claim this important benefit. And, cities can coordinate with their states to encourage participation in state EITC programs, where applicable, in any of 31 states across the country that offer them, which can further assist families in need.

DISCLAIMER: This article is intended to inform local governments, employers, and nonprofits on the opportunity for EITC outreach and education efforts and not necessarily to provide tax advice. If you have questions about tax filing, please consult a tax professional or contact the IRS.

Earned Income Tax Credit Interest

If you’re interested in learning more or partnering with us, complete and submit the form below.

1See pg. 10 of The Supplemental Poverty Measure: 2017, pg. 10 of The Supplemental Poverty Measure: 2018, pg. 11 of The Supplemental Poverty Measure: 2019, pg. 12 of The Supplemental Poverty Measure: 2020, and pg. 16 of Poverty in the United States: 2021. U.S. Census Bureau.

2Preliminary EITC filers count, total amount, and average amount as of December 2023 according to the IRS.

3See table B-8 on pg. 73 of Poverty in the U.S.: 2021 (U.S. Census Bureau) for a list of programs that lift individuals above the Federal poverty line.

4According to the IRS the national EITC participation rate in 2020 was 76.3%. Therefore 23.7% of those eligible did not file. 26.0M filed, which means that an estimated 34.1M = 26.0M / 76.3% filers were eligible resulting in a difference of 8.1M EITC filers.

5The IRS has not yet released its estimates for 2021 and 2022 EITC participation rates, which is needed to calculate the estimated total EITC eligible filers and benefit.

6The IRS estimates that 20% of eligible filers do not claim the EITC in a typical year, which means that only 80% of those eligible to file. To estimate the total number of eligible filers I divided the total IRS reported EITC filers each year by 80% (see endnote iii above about the calculation for 2020) and multiplied that by the average reported benefit to get the total benefit. To calculate the additional EITC filers I then subtracted the IRS reported filers and multiplied that by the average benefit for that year to calculate the estimated additional payments assuming full participation.