The Great Resignation and the retirement of the Baby Boom generation are continuing to have major impacts on the size of the state and local government workforce, with recruiting and structural changes following.

MissionSquare Research Institute and its research partners at the Public Sector HR Association and National Association of State Personnel Executives have conducted an annual survey of state and local government human resource managers since 2009, focused on recruitment, retention, benefits, and other topics like flexible work arrangements, diversity, equity, and inclusion initiatives, and retirement readiness.

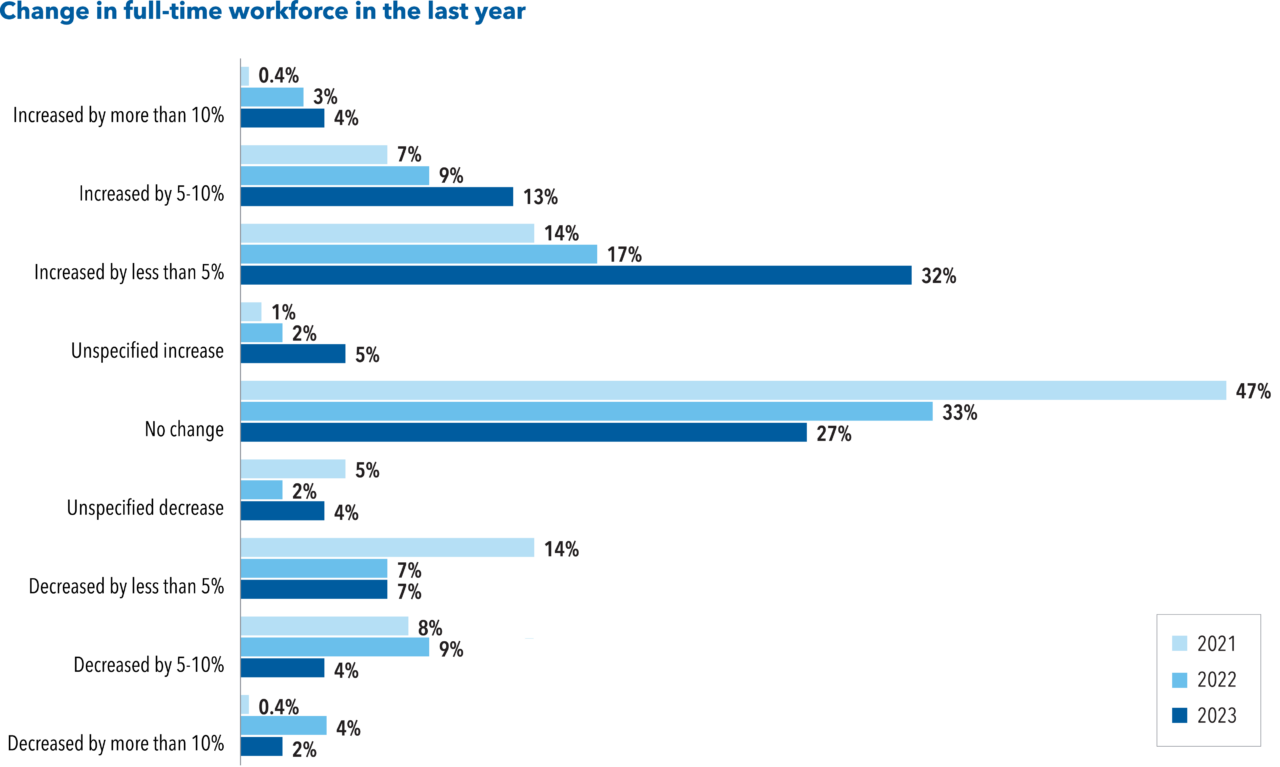

Overall, survey responses indicate that state and local employment continues to lag about 2% behind pre-pandemic levels, [i] but hiring has been ticking up. According to the 2023 State and Local Government Workforce Survey, more than three times as many governments reported their full-time hiring increasing than decreasing.

Regardless, with only 10-11% of respondents seeing resignations and retirements decrease from the prior year, job openings hit a 20-year high.[ii]

From MissionSquare Research Institute surveys of public sector employees who remain, 77% say that the number of people leaving has placed a strain on their workload, and 59% say they are considering leaving.[iii]

The 2023 State and Local Government Workforce Survey results show the impacts on government staffing and how employers are working to stem the tide.

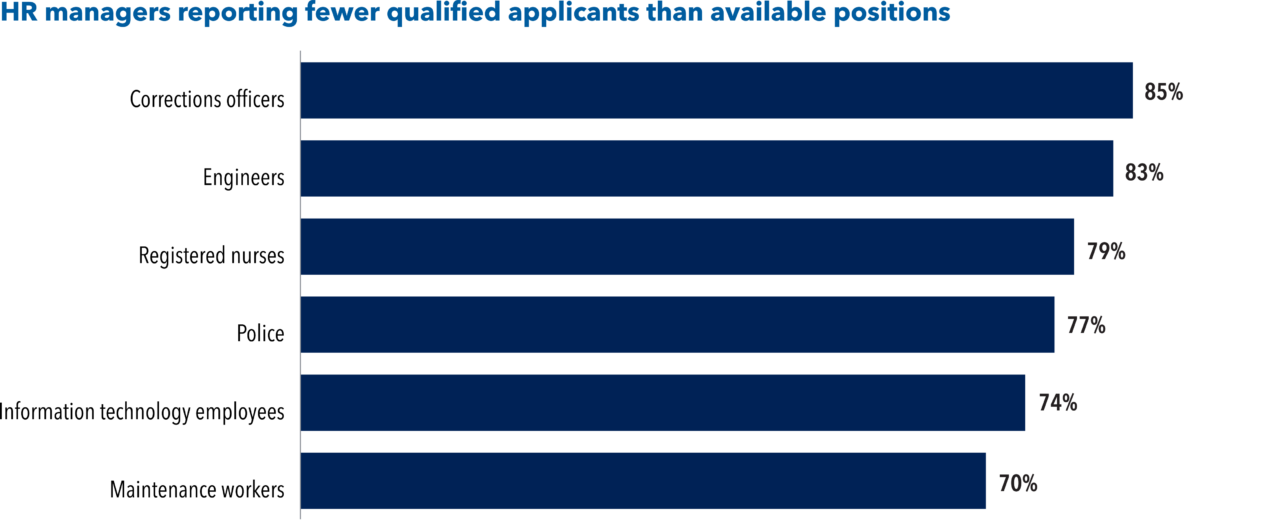

Filling vacancies has been the most acute challenge, with several key positions in public safety and other fields receiving fewer qualified applicants than there were positions available to be filled.

In addition, 51% of HR managers surveyed say they frequently have to reopen recruitments because there were insufficient qualified candidates, and 36% report an increase in time to hire.

As organizations review all aspects of recruitment, a key focus is compensation. Only 55% of HR managers surveyed see their compensation as being competitive with the labor market, while 89% see their benefits that way. In the 2023 survey, 62% of HR managers reported providing broad-based pay increases, while 27% provided more targeted increases.

Job descriptions and expectations are also evolving, with 65% of respondents performing compensation or classification studies, 42% updating specifications for requisite education and skills, 29% dropping degree requirements for at least some positions, and 20% hiring below minimum qualifications for post-hiring upskilling.

Structurally, the staff shortage is changing the shape of the workforce as well. Flexible work practices are most noticeable, with 58% of respondents offering hybrid scheduling and 10% hiring staff to work exclusively off-site. In addition, 5% are restructuring full-time positions into part-time ones, 10% are hiring staff to work exclusively off-site, and 10% are reducing or restructuring services due to continuing vacancies. Where retired staff with necessary skills have been available, 33% have rehired them on at least a part-time basis.

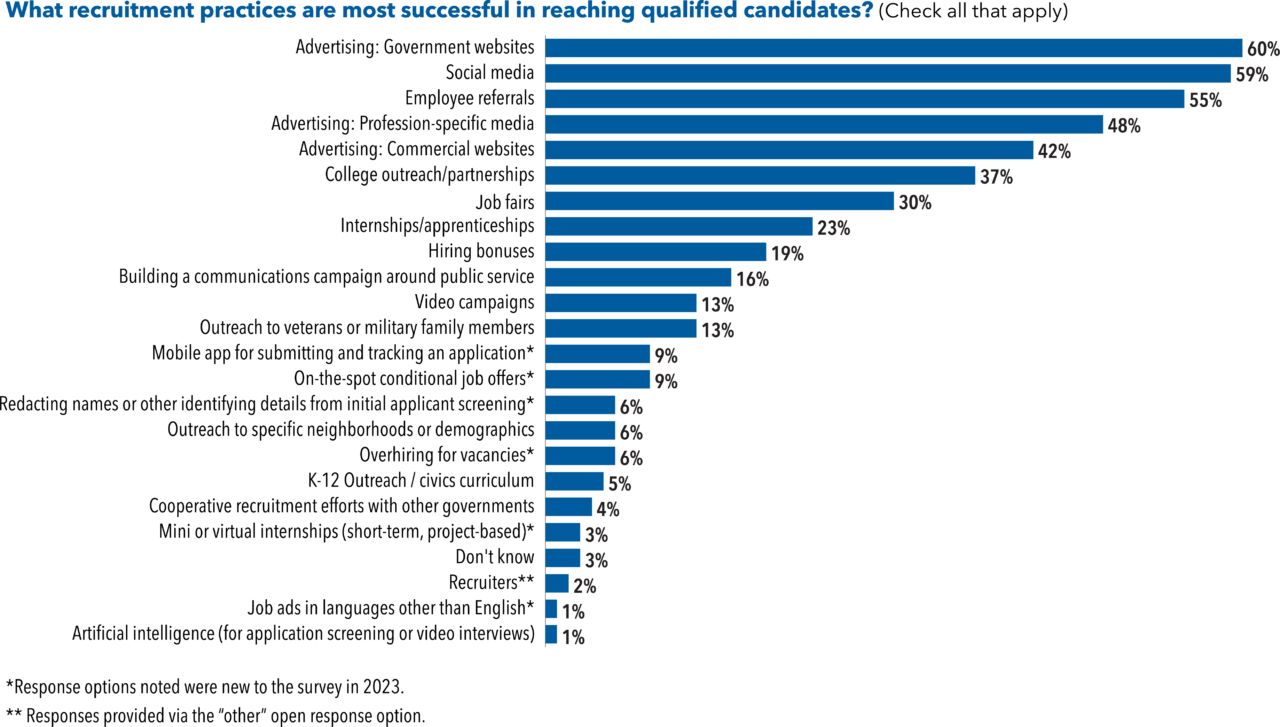

Social media is among the top recruitment methods HR managers are using (59%, second only to advertising on government websites). Other notable strategies include college outreach/partnerships (37%), internships/apprenticeships (23%), video campaigns (13%), and on-the-spot conditional job offers (9%).

Among the ways to improve recruitment results is to reach out to new pools of potential candidates. Generation Z is generally defined as those born between 1997 and 2012, with the older members of that group now a part of the job market. In assessing how well they were reaching that demographic, 50% of HR directors surveyed said they were very or somewhat successful, compared with 26% indicating they were very or somewhat unsuccessful. Other targeted outreach efforts reported have been to veterans and their family members (13%), specific neighborhoods or demographics (6%), and to those for whom English is not their primary language (1%).

Overall, 19% of respondents cited hiring bonuses as an effective recruitment tool, and the most common offerings were targeted bonuses for specific positions (29%) or referral bonuses paid to existing employees (22%). Still, despite the growing interest in bonuses, to this point, only 16% have been collecting data on the effectiveness of bonuses.

Of course, recruitment is only one part of the workforce equation, and the ability to hire new staff is irrelevant if governments are not also able to retain them. This involves a mix of compensation, benefits, employee engagement, career development, and organizational culture, as well as practical details such as whether a minimum period of service is required as part of a hiring bonus.

About the Author

Gerald Young is the senior research analyst at MissionSquare Research Institute.

[ii] Job openings data from BLS Job Openings and Labor Turnover Survey

[i] U.S. Bureau of Labor Statistics (BLS), Current Employment Statistics, as discussed in Issue Brief: State and Local Government Employment Trends, 2023. Unless otherwise noted, all other data is from the 2023 State and Local Government Workforce Survey.

[iii] State and Local Government Employees: Morale, Public Service Motivation, Financial Concerns, and Retention

EXPLORE MORE

Access the State and Local Workforce 2023 Survey Findings for a full exploration of what public sector employers are doing about recruitment, retention and other key workforce priorities.