By now, most local leaders have likely heard of Congress’ historic investment in the Bipartisan Infrastructure Law (BIL). While the funding levels have provided an opportunity for investments directly to municipalities, local governments must still consider their methods to provide the cost sharing funds tied to many of the infrastructure projects to come.

Nothing is free – federal infrastructure projects are cost-shared with the local government that is granted the award. Generally, the federal government will provide up to 80% of the funding while the local government pays about 20% or less if your community faces disadvantages. For any local government considering federal grants, make sure your community is ready to make your match.

Your Local Share in a Federal Grant

The Code of Federal Regulations defines cost sharing as a portion of the project costs not borne by the federal government, and therefore, covered by any other source. In many cases, local governments are granted federal funding in a cost-share model and are left to supplement the remaining costs of the project by their own revenue sources. Most cities, towns, and villages are limited by the types of funds that may be raised and used to cost share with the federal government on infrastructure projects, but sources can be built up over time, loaned, or come from multiple sources – including states and foundations. Communities of all sizes have successfully raised their federal matching funds to leverage the federal dollars to build up their communities.

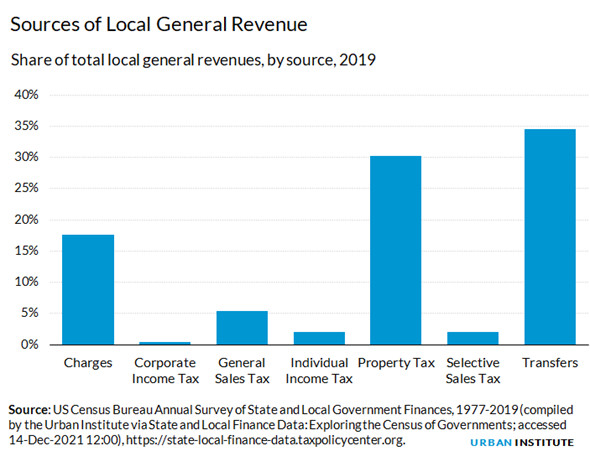

The Urban Institute has been collecting local government (municipalities, counties and other local governments such as school districts) revenues and expenditures. Before the COVID-19 pandemic in 2019, taxes provided 42% of local general revenues, while 34% came from intergovernmental transfers, including 4% from the federal government and 31% from state governments. NLC’s 2021 Fiscal Conditions report shows the impact of federal transfers to local municipalities has had a recent large impact, as 81% of cities reported that federal aid positively impacted their city budgets. Infrastructure needs in the 2021 report were the number one reason negatively impacting city, town, or village budgets, stressing the need of BIL and the ability of local governments to find matches to the programs offered by the federal government.

How to Raise Your Match

Ways local governments choose to raise local matching funds vary, but some methods are common across states. Your state’s laws may offer more or fewer ways to raise funds, and special rules may exist to support infrastructure fundraising specifically.

In 2016, National League of Cities (NLC) released a report overviewing nationally how local infrastructure projects were funded across the country and outlined some of the challenges and opportunities with funding sources.

Below are some of the ways cities, towns, and villages are matching the federal government dollars invested into their important projects.

Local Taxes

In some states, local governments can implement a local option sales tax, gas tax, and implement motor vehicle registration fees to raise funds earmarked for infrastructure related funding purposes. These types of taxes help diversify city revenue streams and provide opportunity for local governments to raise funds to match federal dollars, especially for infrastructure needs.

1. Local Gas Tax

A local gas tax is one revenue source for local governments that can be directly invested by local governments into infrastructure projects to keep vehicles and other forms of transportation moving smoothly. In states where local governments are permitted to issue their own gas tax, this revenue source is often considered as a supplemental funding source for infrastructure projects primarily used to maintain and improve roads. Most of this revenue is earmarked for infrastructure spending, which can be used to match the federal funds in infrastructure projects, but some states allow the revenues to be used for general purposes.

Based on the State and Local Government Finance data from the U.S. Census Bureau, in 2017, local governments that implemented a gas tax raised a total combined revenue of approximately $444 million dollars. These are impactful funds for matching federal dollars in infrastructure projects but are not without challenges due to the fluctuating market and a revenue base likely to decline over time with the introduction of more alternative fuel vehicles (electric, hydrogen and natural gas). For example, during the pandemic, the City of South Bend, Indiana, estimated losing $200,000 in monthly gas tax revenue alone.

2. Local Option Sales Tax

Another revenue source for local governments to use when matching the federal dollars in infrastructure projects is through the local options sale tax. Cities in some states have dedicated portions of the local option sales tax for infrastructure purposes, while other states permit these revenues to be used for general revenue purposes. These local sales taxes are imposed on a broad base of goods and services purchased in an area with a relatively low tax rate but outturns comparatively high revenues.

3. Local Motor Vehicle Fees

In some states, local governments have been authorized to levy a local option motor vehicle fee, with some of those states requiring this fee to be voter approved. These funds can also be dedicated to roads and infrastructure, with some states allowing for the funds to be used for general revenue purposes.

Local Funds

Local governments also have access to their traditional funding options mainly found in careful fiscal management, proactive planning of their budgets and in the form of municipal bonds. Municipalities across America, thanks to the American Rescue Plan, have access to State and Local Recovery Funds and some may have access to other unique reserves.

4. General/Discretionary/Revolving Funds

Cities, towns and villages as a part of their annual planning may set aside funds to fix, maintain or expand their own infrastructure. In 2019, according to the Urban Institute, local governments raised $1.9 trillion dollars, this includes municipalities, counties and special local governments such as school districts. While these general funds can be used to match a grant award to them, most are being used to maintain municipal operations, not expand services.

5. Municipal Bonds

Municipal bonds are a popular way for municipalities to raise funds for infrastructure projects. The municipal bond market had $3.9 trillion in outstanding debt in 2019 and includes both general obligation bonds and revenue bonds. General obligation bonds are traditionally used to raise funds for large projects while revenue bonds are used to finance ongoing projects, like infrastructure upgrades, and are paid back with a tax or fee from the service being offered. An example of this method is toll roads. However, many cities, towns and villages must ask voters for new bonds to be issued.

6. COVID ARPA Funds from Congress

The American Rescue Plan Act gave $350 billion dollars to states, municipalities, counties, tribes and territories, including $130.2 billion for local governments split evenly between municipalities and counties. These State and Local Recovery Funds can be used for some infrastructure projects that help municipalities recover from the pandemic and produce more equitable opportunities and outcomes for all residents. Generally, water and broadband projects are more likely to be eligible than transportation.

7. Special Reserves and Fees

Additionally, many municipalities have discretionary or revolving funds to deal with emergencies, apply for grants, or fund special projects, like the infrastructure opportunities presented in BIL. Many communities carefully built up reserve funds after the 2008 recession, and while they may have been tapped during COVID-19, these funds may still be available or could be raised again in a similar manner. Each community’s ability to raise reserves is influenced by their local context, but when polled, the public has generally been supportive of raising local funds to leverage further federal investment when a clear case is made for the projects.

Local Partnerships

Local governments can match their federal funded projects with other governments sources such as county or state funds or with private or philanthropic funds and grants where they are appropriate. Many of these partners can be included in grant application projects and help make the federal match easier as funds can come from multiple sources. This approach can create ideal situations for federal matches as infrastructure projects often cross multiple jurisdictions and benefit a range of residents and stakeholders.

8. Business Improvement Districts, including Transit Oriented Development

Many cities boast strong local businesses that are eager to see and grow local economic capabilities. In some places, business improvement districts are designated to set aside and reinvest taxes or fees in specific areas. If these special purpose districts are due for upgrades, they can be partners to capture the revenue raised from the improvements to pay for the long-term for the upgrades.

9. Public Authorities and States

Local governments benefit from several independent yet aligned public authorities – including transit, ports, airports and toll authorities – that can be helpful in raising part or all of the local share of a federal project. Many public authorities have specific revenue resources that they can raise funding from and share in the economic benefits of federal funding when it is secured for a region. Additionally, states can provide all or part of the resources for various federal projects if they choose to, and many small communities benefit greatly from leveraging state and federal resources together.

10. Foundations

Many communities share priorities with their foundation partners who may be willing to support a portion or all of a match depending on the circumstances and needs. While there are various philanthropic partners, each may have a distinctive rationale for their support and expectations for the projects. Consider if your community’s aligned goals can lead to the good partners.

While this list is not exhaustive, America’s local governments have a variety of viable options to raise a federal match. Challenges remain to ensure that the amount of funding, timing and support come together at once, but with clear plans and local leadership, many communities have been successful in leveraging local funds to bring greater federal investment to their communities.

If your community would like to share examples of how you achieved your federal match, please don’t hesitate to share those accomplishments with us at advocacy@nlc.org.