It has been one year since President Biden signed the American Rescue Plan Act (ARPA), which provided historic relief to state and local governments and offered direct payments to millions of American families by expanding the Child Tax Credit (CTC). This relief came at a time when municipalities were reeling, with Philadelphia facing a $450 million gap in FY22 and many parents forced to stay home while their children learned remotely.

My team estimated that if every eligible Philadelphian received the expanded tax benefits from ARPA, we could lift 75,000 Philadelphians out of poverty, including 46,000 children. This was more than relief – it had the potential to transform lives and communities. One in four Philadelphians still lives in poverty, and my administration is committed to reducing this number through coordinated efforts and investments. We saw the expanded CTC as a once-in-a-generation opportunity to bring life-changing support to thousands of people, quickly. And the pandemic and global social unrest of the past two years further underscored the importance of advancing racial equity through services, support, and information.

Naturally, we committed to doing everything in our power to reach eligible families, though we knew it would be daunting. The IRS estimated that there were as many as 14,000 kids in Philadelphia whose parents or guardians were extremely low-income and not automatically receiving the advanced CTC payments, and who needed to take action to claim these family-sustaining funds.

Our administration knew that connecting with our hard-to-reach constituents would require a higher level of coordination and innovation. Clear and trustworthy communication and outreach had to be a priority.

Thanks to the flexible funds provided in ARPA, combined with Community Service Block Grant funds from the CARES Act, we invested approximately $2 million in targeted, community-based outreach and enrollment, which included the following:

- Funding trusted non-profit tax prep organizations to increase their capacity so they could serve potentially thousands of new clients for extended portions of the 2021 tax season and the 2022 tax season.

- Using local social service data to identify the most vulnerable households and making over 31,000 phone calls, mailing approximately 20,000 postcards and/or letters, and texting these households four times to connect them with resources to claim the advanced CTC.

- Awarding grants to 17 community-based organizations that are now conducting grassroots outreach for CTC and the Earned Income Tax Credit (EITC) in some of the hardest to reach communities as the 2022 tax season opens.

Additionally, we already required employers to notify their employees about the EITC when they provide W-2, 1099, or comparable forms. Now, we are working with City Council to expand employer notices to include the CTC and our local wage tax refund program to reach even more workers.

Through these and other activities from partners, more than 1,500 Philadelphians claimed more than $6 million in advance CTC payments and unclaimed stimulus dollars using the GetCTC.org portal between August and November 2021. Hundreds of families claimed millions more through our non-profit tax-prep partners or by filing directly with the IRS. While more work remains to be done, we are on track to help thousands more families claim several million more this tax season as our outreach efforts continue.

Work like this in cities across the U.S. made a difference. According to the Center on Poverty and Social Policy, the 2021 Child Tax Credit reached approximately 2 million more children in December than in July. Those are families that might have been left out if not for the myriad of outreach efforts. That translated into moving another 700,000 children out of poverty in the U.S. by July, including nearly 200,000 Black children and 300,000 Latino children.

CTC and EITC are among the most effective anti-poverty programs since Social Security, and our administration is strongly committed to fighting for their continued expansion. Philadelphians are using this money to meet their basic needs — and that spending helps stimulate our economy. Ensuring that every resident gets the tax credits they are eligible for this year is one important strategy in helping our communities recover from the pandemic and build back better.

Get the Most Out of Tax Season

Local leaders should understand the tax changes that can boost their residents’ incomes and where residents can go to claim these funds. We listed the significant tax changes that municipal leaders should know.

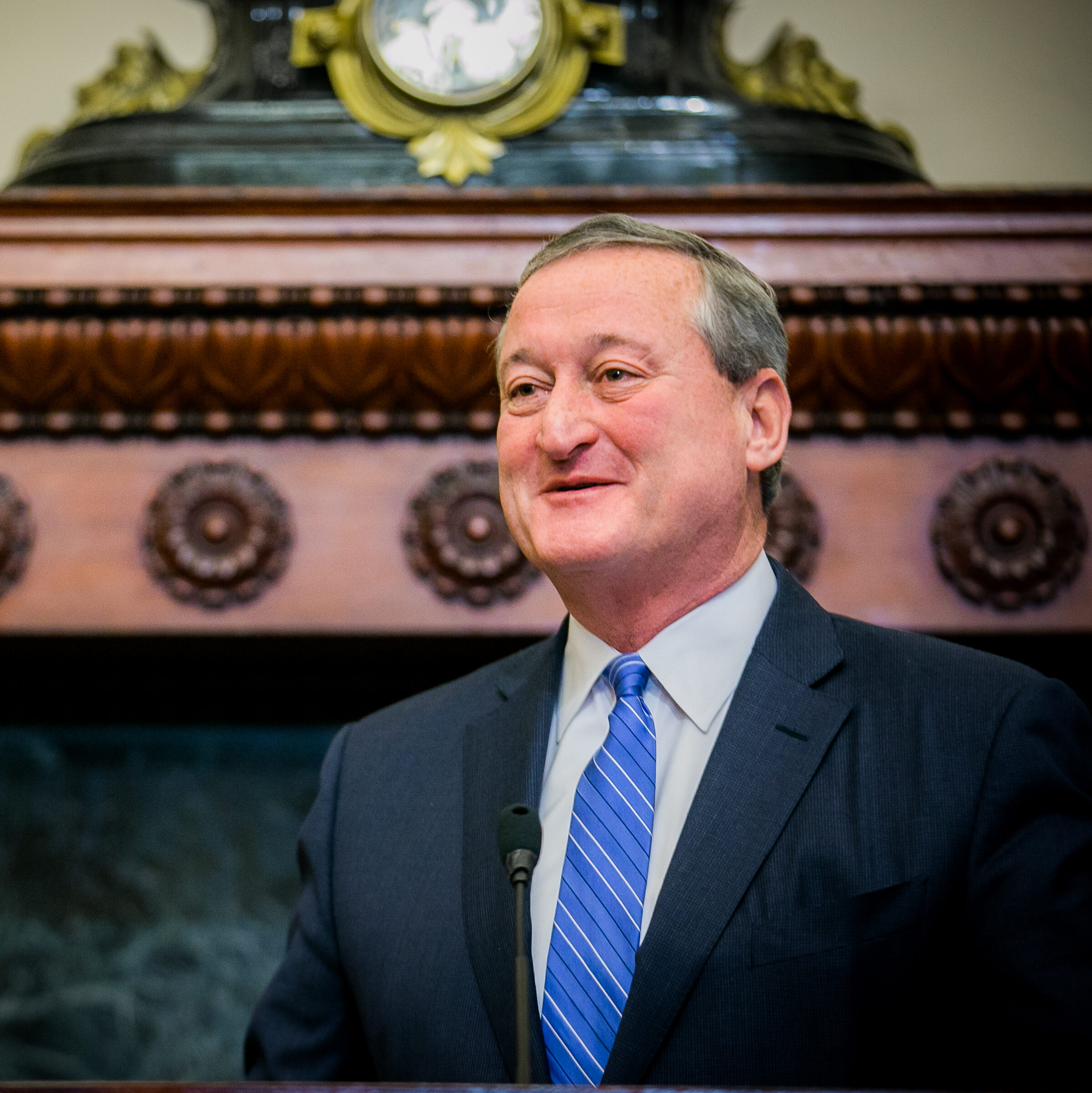

About the Author:

Mayor Jim Kenney of Philadelphia, PA.