Once a mainstay of the American Dream and the cornerstone of building generational wealth, homeownership rates are faltering. This shift is most pronounced among young individuals and communities of color, with the rate of Black homeownership at 44 percent compared to roughly 75 percent for White homeownership. These trends are likely to be exacerbated by the COVID-19 pandemic.

But COVID-19 has also demonstrated the potential of collective action and community empowerment, which are foundational to the community land trust (CLT) housing model. As a model for furthering affordable homeownership (along with retail and commercial spaces), particularly among lower-income households, community land trusts are born out of the community that they serve.

As municipalities consider how to rebuild and reinforce their housing strategies in the wake of COVID-19, community land trusts represent the potential to forge deep connections within a community, while bringing homeowners much-needed stability and support.

Here are Five Distinct Ways a Community Land Trust can Benefit your City:

1. CLTs Leverage a One-Time Investment to Deliver Long-Term Benefits

Many municipalities and nonprofit organizations are on a “hamster wheel of housing subsidies”: With incomes not keeping pace with rising housing costs, funding for new affordable housing often goes into the city just as the affordability requirements on previously subsidized housing expire. Without making provisions for future demand by growing the affordable housing stock, municipalities frequently find themselves in the position of needing more and more subsidies to serve each family.

Permanent affordability changes these dynamics.

CLTs create affordable homeownership opportunities that last by:

- Acquiring and holding land,

- Acquiring, developing or rehabilitating housing on that land (or partnering with others to do so),

- Selling the housing — but not the land — to low-income purchasers at a price they can afford by issuing a “ground lease”, and

- Limiting the price appreciation of the property according to a “resale formula” to ensure that every time the home is resold, it goes to another low-income purchaser at a price that purchaser can afford.

Whether CLTs acquire land on the open market, through land donations, or at a discount through public entities such as city agencies or county land banks, the CLT retains that land in perpetuity for the benefit of the community.

Relative to more typical government subsidies or down payment assistance programs, CLTs may deliver more modest gains in wealth-building for individual households, but they leverage a single investment to provide multiple households with long-term affordable homeownership opportunities.

2. CLTs Directly Address the Growing Affordability Gap in Housing

Once established, housing in a community land trust remains affordable forever. This means that, over time, the stock of affordable housing in a community steadily grows as cities use annual subsidy dollars to create additional housing units, rather than repeatedly working to replace units when their affordability restrictions expire.

The impact of this permanent and growing stock of affordable homes can be transformative. The promise of lasting affordability provides stability for families and opens the door to homeownership.

One study of shared equity homeownership programs, including community land trusts, revealed that 95 percent of such homes are affordable to households earning 80 percent of area median income (AMI), and nearly half of such homes are affordable to very low-income households earning up to 50 percent of AMI. CLTs are thus effective tools for helping low-income households become homeowners by making homeownership more affordable and more stable.

3. CLTs Can Be Powerful Tools for Equitable Wealth-Building

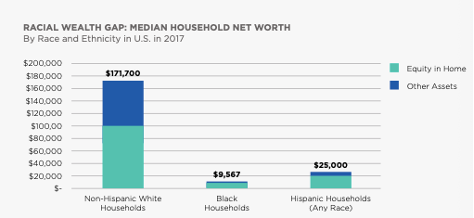

Historically, many low- and moderate-income buyers of color in particular have been unable to afford or qualify for the purchase of a home. This has contributed to a substantial racial wealth gap in our country, with the net worth of non-Hispanic white households in the U.S. at nearly 18 times greater than the net worth of Black households, and nearly 7 times greater than that of Hispanic households.

But with proper targeting, CLT homes have significant potential to help low-income households of color access homeownership and build wealth.

In 2000, just 13 percent of community land trust homeowners were people of color. By 2018, that figure had increased to 43 percent. Cities can work to expand opportunities for shared equity ownership among Black, Hispanic/Latino, Asian and Indigenous households by supporting shared equity programs in targeted neighborhoods and removing common barriers to homeownership.

4. CLTs Help Communities Resist Gentrification and Displacement

In many cities, home prices are increasing faster than local incomes. In some neighborhoods, this problem is acute — prices are skyrocketing well beyond the reach of residents who have long lived there. Often it is people of color who find themselves excluded from a neighborhood they could once afford as processes of gentrification take hold.

CLTs help communities resist these economic and cultural disruptions because CLT homes remain affordable, even as the cost of homes around them continue to increase. The presence of CLTs in a community can moderate forces of change, contribute to neighborhood stability, combat the negative effects of gentrification, and create or preserve diverse, mixed-income neighborhoods.

5. CLTs Enable Communities to Better Weather Economic Downturns

With the CLT commitment of stewardship comes a level of stability that can help cities as a whole weather shocks to the system.

Bolstered by this support, CLT homeowners are much less likely to move in any given year than their counterparts in market-rate homes. Additionally, during the 2008-10 housing crisis, homeowners in CLTs were 10 times less likely to be in foreclosure proceedings and eight times less likely to be seriously delinquent than homeowners across all incomes in the private market.

This is a level of additional security and stability that can often be felt community-wide, and is particularly key in times of uncertainty such as that caused by the COVID-19 pandemic.

Learn More

To learn more about how community land trusts can benefit your community, a new report from National League of Cities and Grounded Solutions Network offers an introduction to the community land trust model in the context of housing, sheds light on the benefits CLTs bring to both residents and cities, and highlights key ways that municipal governments and local leaders can initiate or support CLTs in their communities.