Despite significant fiscal challenges over the past 18 months, for the most part, cities demonstrated greater resilience than expected through the pandemic. Why? Using survey and fiscal data from 444 cities, NLC’s new analysis, City Fiscal Conditions 2021, reveals four key factors that buoyed city finances during one of the most turbulent health and economic crises of our time.

1. City finances had finally recovered from the Great Recession just when the pandemic hit.

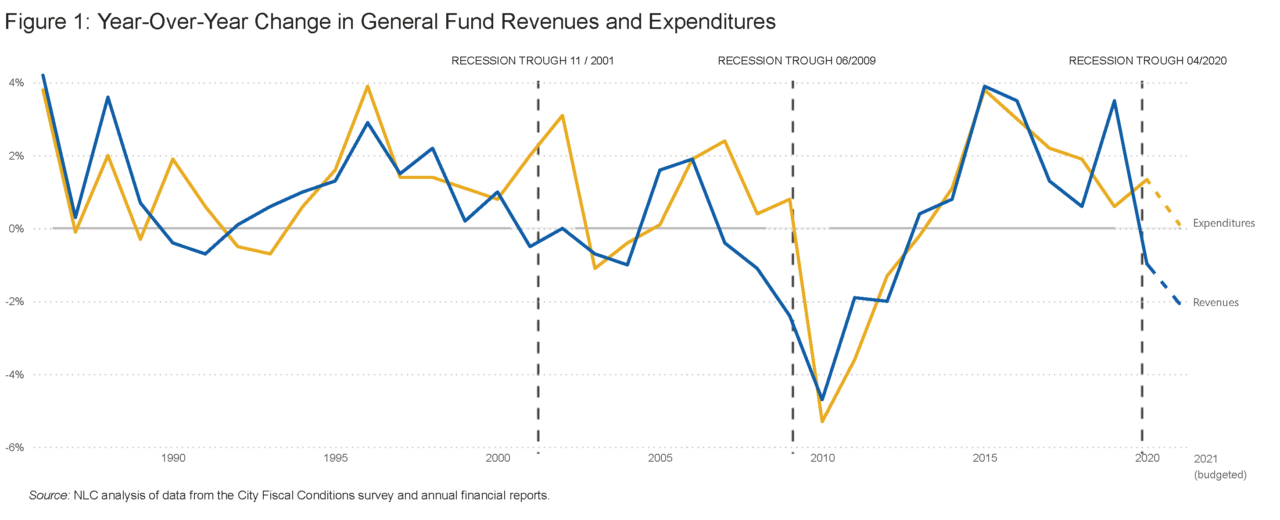

Most cities were in a strong fiscal position in the years leading up to pandemic, and many experienced particularly robust General Fund revenue growth in the first three quarters of fiscal year 2020 (July 2019 – March 2020 for most cities). In spring 2020, as COVID-19 took hold, basic community needs increased immediately while revenues plummeted. The recession of 2020 was both the shortest and deepest recession on record. It wiped out all 2020 city revenue gains and then some, resulting in a decline for the year despite a strong start. Cities budgeted for further decline in fiscal year 2021.

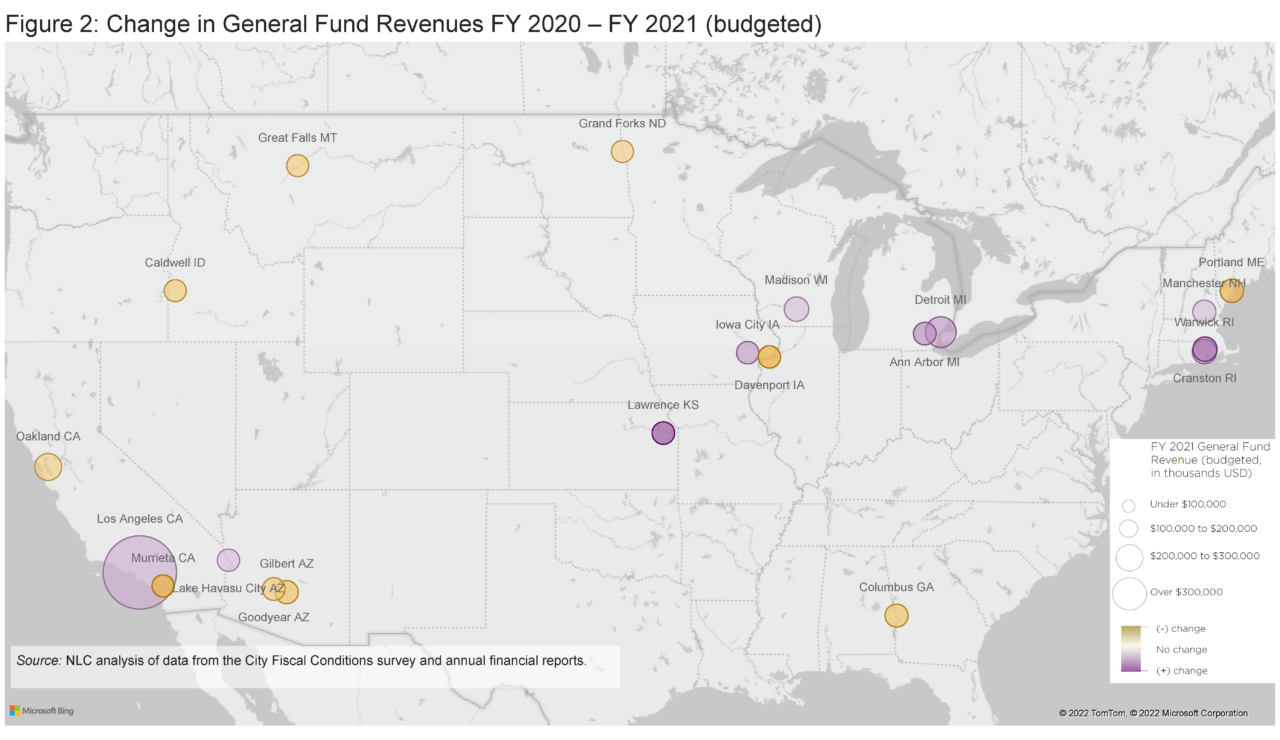

If local finances were not so strong heading into the pandemic, cities would have experienced a more severe fiscal downturn over the past year and a half. But of course, not all cities were impacted in the same ways. While in most years, most cities are within one to two percentage points of the average year-over-year change in revenues, this year, more than five in 10 cities budgeted for a greater-than-five percentage point difference than the “average” city, with most experiencing more significant severe declines. Some cities, like Hartford, CT; Missoula, MT; and Battle Creek, MI were still financially struggling even before 2020. Others, like Dallas, TX; Rio Rancho, NM; and Colorado Springs, CO were steadier in their fiscal standing throughout the pandemic. Much of their ability to be resilient in the face of the unique contours of pandemic-induced recession is the result of communities’ economic structures and types of revenues they collect.

2. Recent home price surges are not buoying city finances…yet.

The real estate market in much of the nation surged in the spring and summer of 2021. Property tax receipts, however, lag the underlying economy’s changes due to assessment practices and because property does not change hands frequently, requiring assessors to estimate the value of real estate property. Consequently, property tax receipts today tend to reflect the value of property from one, two or three years in the past. The sharp and sudden closing of the economy in March 2020 may have reduced real estate values but not real estate tax collection because property tax bills in March 2020 reflected the property’s value a year or two prior to the shutdown. In fact, as expected, real estate tax receipts increased in 2020 and even slightly in 2021. Real estate and property tax revenue remained generally stable to strong during the pandemic, with the recent surge in property values expected to impact cities in the years ahead.

3. Online sales tax collection came to the rescue in many cities.

The U.S. Supreme Court’s South Dakota v. Wayfair decision in 2018 helped blunt what could have been a disastrous fiscal situation for cities dependent on sales tax. Over half of all municipal governments in the nation rely rather heavily on sales taxes to help provide general services. Considering the severe impacts of the COVID-19 pandemic on economic activities and brick-and-mortar shopping, the ability to collect sales taxes online provided a lifeline for many cities that rely on this source of revenue.

4. Proactive federal policy supported economic stability and provided direct assistance to cities.

In addition to federal support given to households and businesses (including cash, grants, loans, the eviction moratorium and insurance benefits) throughout 2020 and 2021 that impeded an economic freefall and created more stable local tax bases, large local governments were provided direct relief through the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020, and all cities, towns and villages across the U.S. were provided relief as part of the American Rescue Plan Act (ARPA) that passed in March 2021.

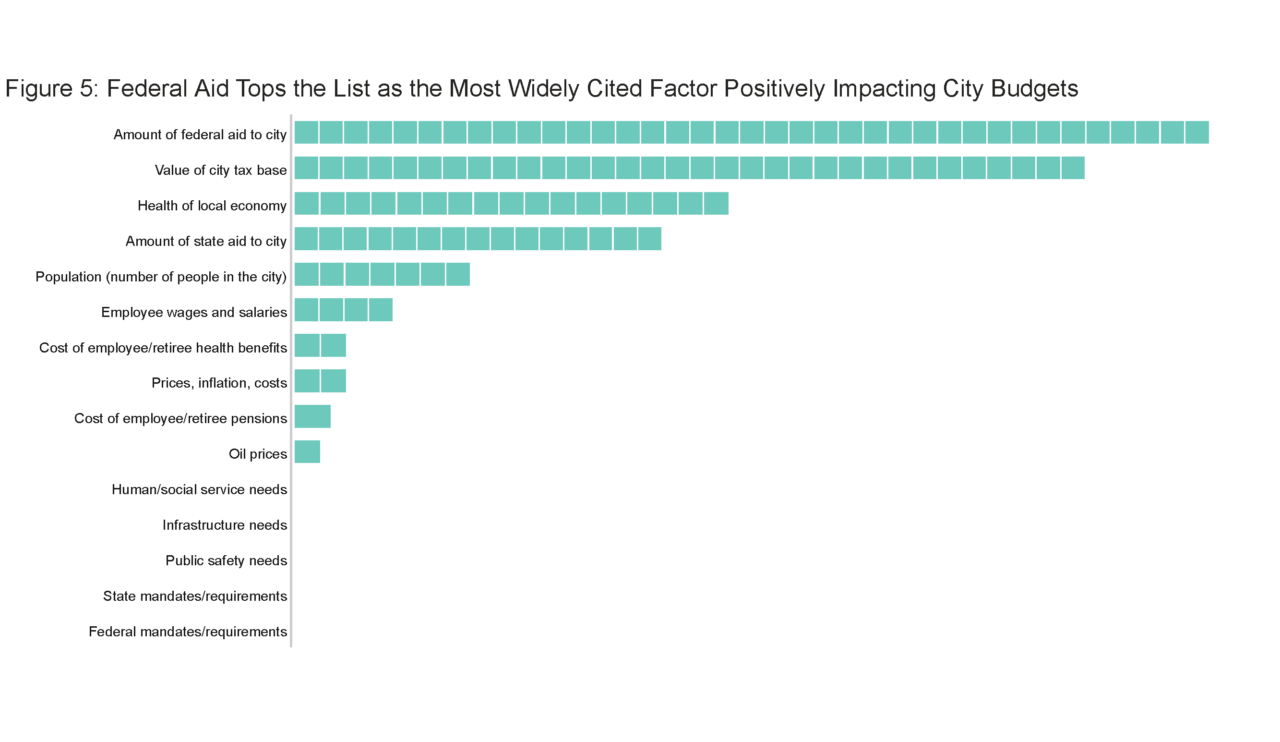

Indeed, when asked about the factors that had the most significant positive impact on their cities’ abilities to balance their budgets in fiscal year 2021, more than eight in 10 finance officers indicated that federal aid was critical. The City of Philadelphia’s Budget Director, Marisa Waxman, noted, “Without ARPA, the city would be facing a $450 million shortfall in fiscal year 2022 and estimated a shortfall of $1.5 billion through fiscal year 2026. ARPA enables the fiscal year 2022 budget to include new investments like 911 co-responder and mobile crisis units, violence intervention and community response programs, a Citizen Police Oversight Commission, and covered debt service for street paving.”

Beyond 2021, the most significant and prevalent challenge facing city budgets is infrastructure. Infrastructure obligations put extra pressure on already-strained city resources, and remains the top factor negatively impacting city budgets this year and beyond. As our federal leaders debate the bipartisan infrastructure bill and budget reconciliation bill, the fragile fiscal stability of our nation’s cities, towns and villages is at risk.

Take Action

Local leaders can take action to encourage Congress to vote ‘yes’ on the Infrastructure Investment and Jobs Act and ensure that city priorities, including workforce development and training, are included in the reconciliation bill. Your voice can make a difference, send a letter to your members of Congress today.